GIFTS OF SECURITIES

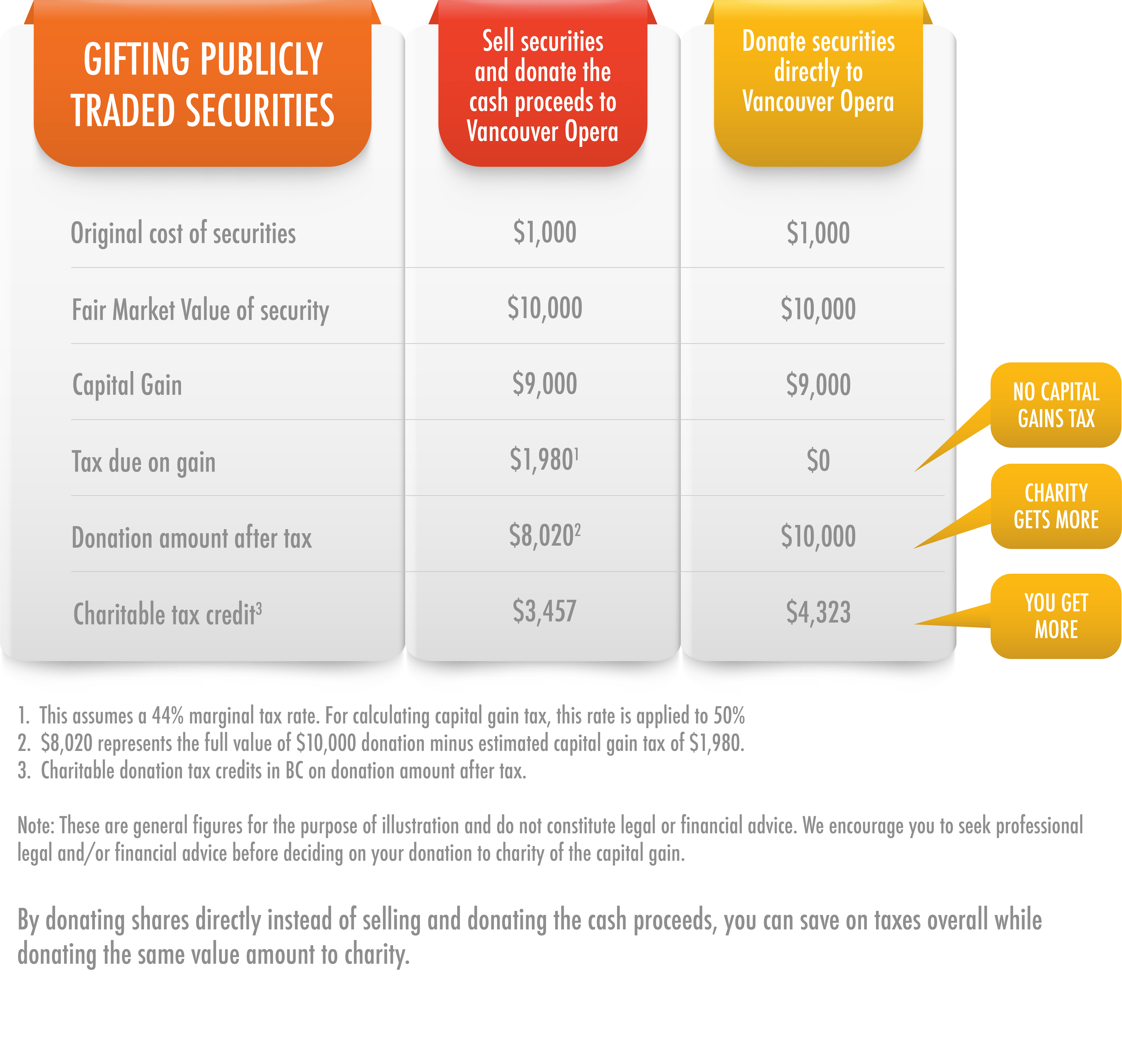

A gift of publicly traded securities is both simple and tax effective. When you donate securities, you do not pay capital gains tax AND you receive a charitable gift tax receipt to use against other income. You can benefit tremendously from this added incentive to reduce the real cost of your charitable giving or increase the amount of your gifts without increasing the costs. You can make a gift of securities at any time, or make it part of your estate plan.

You and your broker or investment advisor may transfer these types of gifts electronically into Vancouver Opera’s brokerage account by using our Share Transfer Form. You’ll receive a tax receipt for the fair market value of the gift, based on the closing price of publicly traded securities on the day the gift is received in Vancouver Opera's brokerage account. Your support furthers Vancouver Opera’s mission to create extraordinary experiences that engage, inspire and entertain our community through voice, music and theatre. Download our Share Transfer Form or contact Bella Dingman at bdingman@vancouveropera.ca to get more information about Gifts of Securities.